Zib

-

Posts

91 -

Joined

-

Last visited

Content Type

Profiles

Articles

TU Classifieds

Glossary

Website Links

Forums

Gallery

Store

Posts posted by Zib

-

-

My bender is not currently mounted so I can't post a pic. All I did was drill 2 holes through my computer desk (old desk) that lined up with the holes in the base of the bender & made sure that there was enough room for the bottom handle to make a complete 360 degree turn without hitting the underside of the desk. I only have it bolted down while I'm bending wire then remove it to make room to do other things.

-

Yes, you make the loop using the bottom handle. First you make the "R" bend then flip it over to bend it the other way. The wrapping of the wire around the shaft is done at the top part of the bender.

-

If you don't mind using powder paint then use the Pro Tec "Candy Yellow" it's refered to as anti-freeze by the guys that do their own walleye jigs. Using a white base coat makes it stand out nice.

-

I use the Hagen's wire form tool with the conversion kit for bending the larger .051" wire. It cost more than the Boggs but you can bend more different types of forms.

-

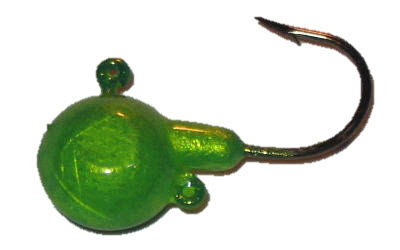

Here's some that Do-it sells. You can use a dremel to place the line/hook ties in different location if you want.

http://do-itmolds.com/shop/index.php?route=product/category&path=1_9_57

-

I melt down the old jigs that I snag while jigging the Detroit River for musky. I use my cast iron pot instead of my Lee pot because I don't want my Lee pot to get clogged with paint, rust etc. I use the side burner on my BBQ grill.

-

Has anyone had any issues using M-F salt water plastic? I’m new to making soft plastic lures & I plan on making some soft plastics for musky/pike jigging & want soft plastic that is durable & will hold up to teeth the best. Is the M-F Salt Water plastic a good choice or is there better soft plastic out there? I’ve done a search in the forums but can’t seem to find the answer I’m looking for so I apologize if I’m asking a questions that already been answered.

Thanks

-

In addition to the places listed above:

Hagen's

Moore's Lures

Lakeland Inc.

-

I use 2 curved hemostats when powder painting my walleye jigs. I use 1 to heat the jig over the heat gun then use the other to clamp onto the eye of the hook & dip it in my fluid bed.

-

Thursday night I made up 5 bucktails to use Friday morning on Lake St. Clair. I ended up using 2 of them & caught fish on both , including my first musky (48") of the 2009 season.

I was fishing by myself without a musky net so the pictures suck because I couldn't get the self-timer to work.

Here's the lure that caught it. MY buddy named it "Big Sexy" because he caught his first of the season on the same color & style that another friend made.

Here's a couple of several LM that were caught on the bucktails as well.

-

Using those rain gutter sleeves is a great idea. Thanks for sharing.

-

I have a Chicago Electric that I bought at Harbor Frieght for $16.99. I use it for powder painting & other things around the house & garage. After a year of use it still works fine. If you are using it for powder painting make sure you get one that can stand up by itself so that your hands are free for other things.

-

I like the action on that thing.

About 15 years ago I bought a jig very simular to that one. The only difference was the one I had the lip was narrower & the jig itself was lighter & painted. The one I bought came with a curly tail rigged on it. I don't ever remember using it though. I may still have it in my old tackle box that's burried in my basement. If I remember I'll look for it & post a picture if I find it.

BTW, have you ever seen a Scrounger Head?

-

1

1

-

-

A football jig should basically work like the jig you have pictured. You could also modify a football head mold to get that shape.

-

The VMC Barbarian V7150BK are a little thicker/heavier than the 570 & they don't bend out that easy. They are a good hook with great hook-ups & few lost fish compared to the 570.

-

I'm not so sure about this...

You paid the FET on components because you bought "retail" without an exemption.

If you sell your finished product (components, FET and value added services) as a "wholesale" product to be retailed by someone else then they, the retailer are obligated to collect the FET on the purchase.

However if you sell as the retailer to the end user/consumer...

That is where I get confused? Since the components were already sold as retail once and the FET was collected and paid by whom you purchased from: are you then obligated to collect FET on the retail of your finished product as well? Or can you claim that the FET was paid on the retail sale of the products components?

And I'd imagine if you file for an exemption you had better keep very good records on your inventory. Any discrepancies will be seen as sales without collection of the FET by an audit.

I'm just getting started on all of this myself. And until I understand all of the ins and outs of this, I'm just going to pay the FET on my components and pass that on as an expense on my wholesale cost.

I'd retail it myself too but until I have a firm grip on the above scenario I'm going to have to wait.

The manufacturer is liable for the payment of FET on the sale price of the product. The manufacturer adds 10% to the sales price that he charges the retailer or direct consumer. The 10% is included in the price but the purchaser usually doesn't know that 10% is included the price. They only see $8.99 for a Spro Little John & end up paying sales tax on top of that FET so the product is double taxed.

Here's a little more of the IRS website:

Who is Liable for the Federal Excise Tax (FET)?

IRC 4161 imposes an excise tax on the sale of sport fishing equipment, bows, archery equipment and arrow shafts (exception for certain wooden arrows designed for children effective October 4, 2008). This tax is imposed on the manufacturers (a term which includes producers and importers) of these products. In order to determine the proper taxpayer we must understand how the code defines these terms.

Manufacturer:

Regulation Section 48.0-2(a)(4)(i) defines a “manufacturer” to include any person who produces a taxable article from scrap, salvage, or junk material, or from new or raw material, by processing, manipulating, or changing the form of an article or by combining or assembling two or more articles. The term also includes a “producer” and an “importer.”Regulation Section 48.0-2(a)(4)(ii) states that under certain circumstances, as where a person manufactures or produces a taxable article for another person who furnishes materials under an agreement whereby the person who furnished the materials retains title thereto and to the finished article, the person for whom the taxable article is manufactured or produced, and not the person who actually manufactures or produces it, will be considered the manufacturer.Here's the link for more info:http://www.irs.gov/businesses/small/article/0,,id=203117,00.html' rel="external nofollow">With regard to sales tax theSELLERis responsible to pay the tax to the State government. The Seller has the right to collect the sales tax. -

My Question on FET.

If I pay FET on my components to make the tackle,,, do I have to pay it again on the finished product that I sell to my dealer???? If so sounds like double taxation to me.

When you pay FET on the parts then you will just adjust it on the form when you send it in. You will still have to pay FET on the selling price.

-

This is the place where you can get the pourous filter media for the cups. The problem with buying though is that you have to buy in large quanties & for the home user it's just not worth it.

-

I don't know of ANY state that requires a business to pay sales tax on products that are sold & shipped out-of-state. I'm a tax compliance auditor with the State of Michigan & I audit sales tax, use tax, & business tax. There have been some States that have been trying for years to get a "Streamline" Sales tax agreement passed with other states but because 5 States don't have sales tax they can't come to an agreement.

Also be aware that there is a Federal Excise Tax of 10% on lure manufactures that require you to pay on the selling price.

-

Thanks for the replies guys. I ordered the Hagen's (w/adapter) & should have it next week.

-

I'll be buying the adapter as well because all my musky baits will be made with .051" wire.

-

Hey guys,

I was planning to buy a Boggs Tackle Marker for a B-Day present to myself.

However, since I plan on making large musky bucktails (10" to 13" total length) I didn't think the Boggs would handle the longer shaft. I seen that Boogs has the extension that you can use with the base cut in half but was wondering if that will still have some limitations? Are there any limitations with regard to the Hagen's making the bigger bucktail spinners? I'll also be making smaller French spinners for bass. Should I buy the Boggs with the extension or should I just get the Hagen's?

However, since I plan on making large musky bucktails (10" to 13" total length) I didn't think the Boggs would handle the longer shaft. I seen that Boogs has the extension that you can use with the base cut in half but was wondering if that will still have some limitations? Are there any limitations with regard to the Hagen's making the bigger bucktail spinners? I'll also be making smaller French spinners for bass. Should I buy the Boggs with the extension or should I just get the Hagen's?Thanks

-

Has anyone made a lure using a photo overlay? If so where did you get the photo overlay from?

Thanks

Here's what I'm talking about:

-

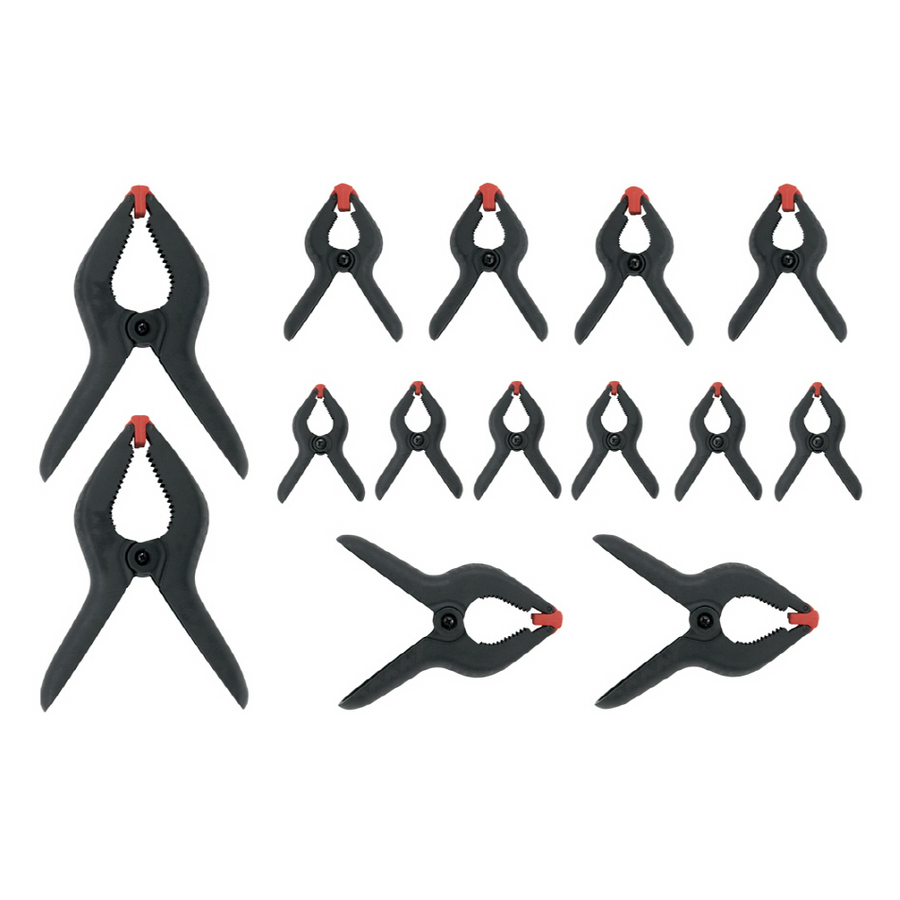

Couldn't you just use clamps like these or would they damage the mold?

Cork Seal

in Rod & Reel building & repair

Posted

I use the U-40 cork sealer on my rods & they have held up great. I've used it for 2 seasons now & cork still looks good. To clean the cork before applying I used a Mr. Clean Magic Eraser with water & the cork cleaned up very nicely.